Economic uncertainty is a constant challenge for businesses of all sizes. At Hazeltine Executive Search, we’ve seen firsthand how unprepared companies can struggle during economic downturns.

Building resilience is key to weathering these storms and emerging stronger. This guide will provide practical strategies to help your business thrive, even in uncertain times.

What Is Economic Uncertainty?

Definition and Scope

Economic uncertainty refers to the unpredictability of future economic conditions. This phenomenon affects businesses across all sectors, making it challenging for companies to plan and make informed decisions.

Causes of Economic Uncertainty

Several factors contribute to economic uncertainty:

- Global Events: Pandemics (like COVID-19), geopolitical tensions, and trade disputes significantly impact markets.

- Technological Advancements: While offering opportunities, they can disrupt traditional business models. The rise of artificial intelligence and automation reshapes industries and job markets.

- Policy Changes: Shifts in government policies (fiscal, monetary, or regulatory) can create uncertainty for businesses.

Impact Across Sectors

Economic uncertainty affects different sectors in various ways:

- Manufacturing: Reduced orders and inventory buildup

- Retail: Decreased consumer spending

- Technology: Shifts in investment patterns

- Financial Services: Challenges related to interest rate fluctuations and regulatory changes

- Energy: Price volatility (especially in oil and gas) caused by geopolitical events

Key Indicators to Monitor

To anticipate potential economic downturns, businesses should watch several key indicators:

- GDP Growth Rate: Global growth is expected to decelerate markedly from 5.5 percent in 2021 to 4.1 percent in 2022 and 3.2 percent in 2023 as pent-up demand dissipates.

- Unemployment Rates: Rising unemployment can indicate economic instability.

- Consumer Confidence Index: This monthly report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates.

- Purchasing Managers’ Index (PMI): This indicator provides insights into the manufacturing sector’s health. A PMI below 50 suggests contraction.

- Yield Curve Inversion: When short-term bond yields exceed long-term yields, it often precedes a recession.

Preparing for Economic Shifts

Monitoring these indicators helps businesses prepare for potential economic shifts. However, no single indicator provides a complete picture. A holistic approach, considering multiple factors, is essential for effective planning and risk management in uncertain economic times.

It’s important to consider how businesses can build financial resilience in the face of these uncertainties. Let’s explore strategies to strengthen your company’s financial position and weather economic storms.

Financial Strategies for Uncertain Times

Diversify Revenue Streams

Companies that expand their revenue sources increase their resilience to economic fluctuations. A manufacturing business could add service-based offerings or develop digital products to complement physical goods. McKinsey reports that 24 percent of new businesses started by large corporations went on to become viable, large-scale enterprises.

Build a Strong Cash Reserve

A robust cash reserve helps businesses navigate economic downturns. Companies should try to maintain enough cash to cover at least six months of operating expenses. This buffer provides flexibility and time to adapt to changing market conditions. (The U.S. Small Business Administration suggests small businesses keep three to six months of operating expenses in reserve.)

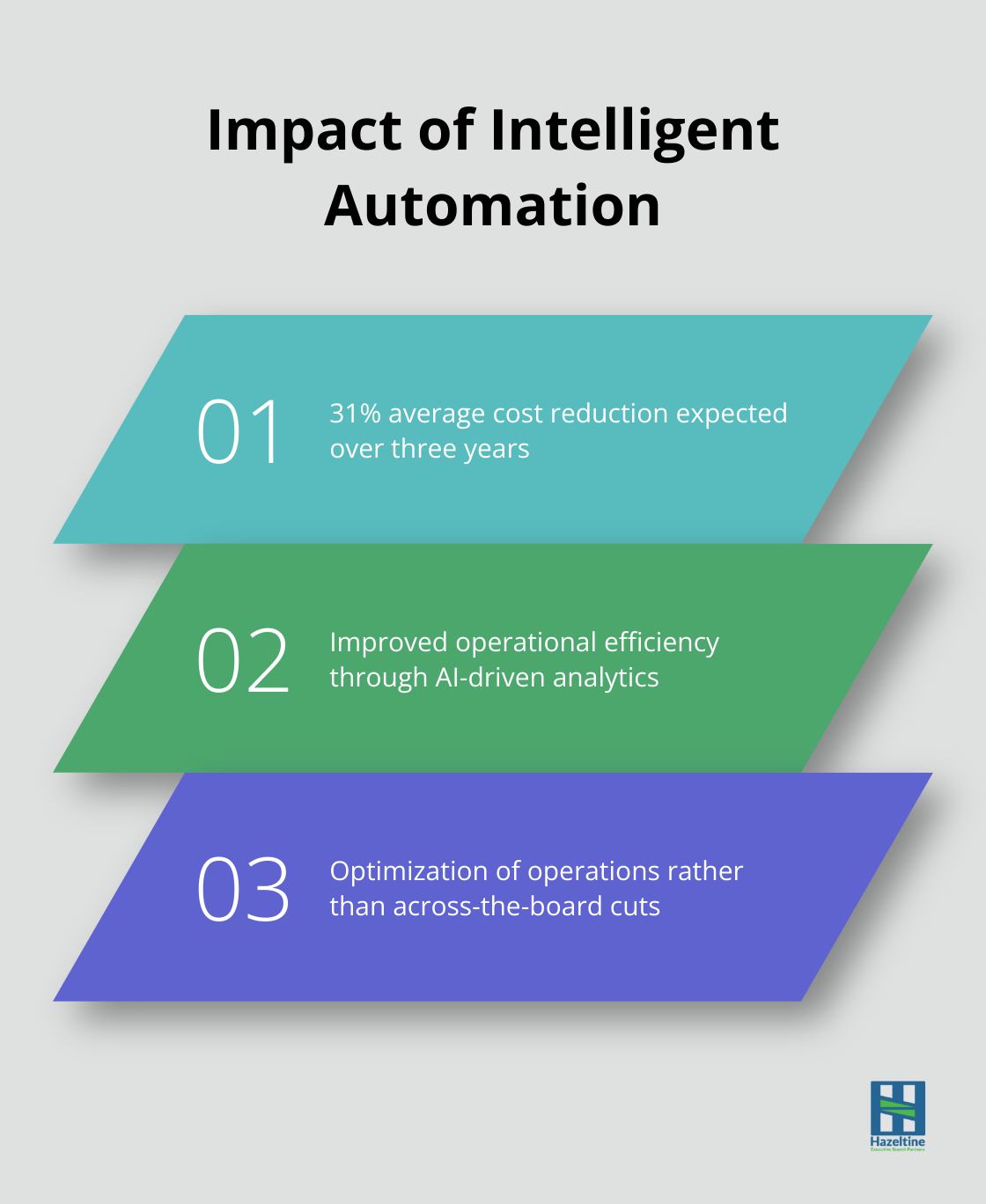

Implement Smart Cost Management

Effective cost-cutting requires a balance between reducing expenses and maintaining quality. Companies should focus on optimizing operations rather than making across-the-board cuts. Automation and AI-driven analytics can significantly improve operational efficiency. Deloitte found that organizations expect to achieve an average cost reduction of 31 percent over the next three years by adopting intelligent automation.

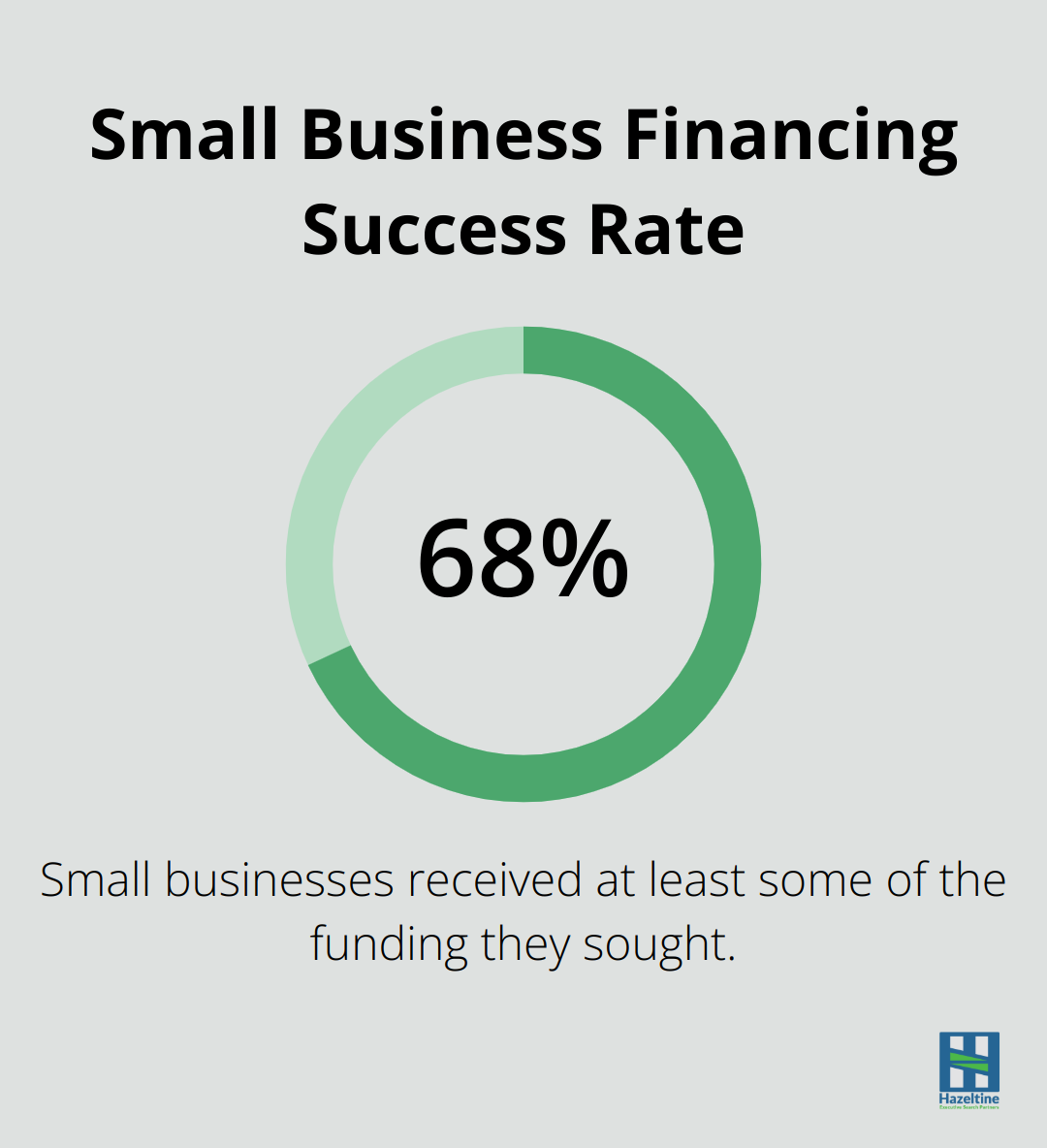

Explore Flexible Financing Options

Alternative financing options can provide additional financial cushioning. Companies should consider revolving credit lines, invoice factoring, or equipment leasing. These alternatives often offer more flexibility than traditional loans, especially during uncertain times. The Federal Reserve’s 2022 Small Business Credit Survey showed that 68% of small businesses that applied for financing received at least some of the funding they sought.

Monitor Key Financial Metrics

Regular tracking of financial metrics helps businesses stay ahead of potential issues. Key indicators to watch include cash flow, accounts receivable turnover, and debt-to-equity ratio. This proactive approach allows companies to identify and address financial challenges before they become critical.

Financial resilience requires preparation for various scenarios, not predicting the future.

Operational Agility in Uncertain Times

Streamline Business Processes

Agile business processes form the backbone of a resilient organization. Map out your current workflows and identify bottlenecks. Implement lean methodologies to eliminate waste and improve efficiency. Toyota’s lean manufacturing principles have helped the company reduce inventory costs by 50% and increase productivity by 100% over the years.

Project management tools like Asana or Trello can improve team collaboration and task tracking. These platforms can increase productivity by up to 25% (according to a study by Forrester Research).

Leverage Technology for Efficiency

The right technology can significantly boost operational efficiency. Cloud-based solutions offer flexibility and scalability. Companies that have adopted cloud technology have seen an average 20.66% improvement in time to market.

Automation is another key area for investment. Robotic Process Automation (RPA) implementation has been explored in various industries through numerous case studies. Identify repetitive tasks in your organization that could be automated, such as data entry or invoice processing.

Develop Robust Contingency Plans

Create contingency plans for various economic scenarios. Conduct a thorough risk assessment of your business. Identify potential threats and their likelihood of occurrence. Then, develop specific action plans for each scenario.

If your business relies heavily on imports, create a plan for potential supply chain disruptions. This might include identifying alternative suppliers, stockpiling critical components, or developing local manufacturing capabilities.

Regular scenario planning exercises can help your team stay prepared. The oil company Shell has used scenario planning since the 1970s, which has helped them navigate numerous oil price shocks and market disruptions.

Prioritize Employee Development

Your workforce is your most valuable asset in navigating uncertain times. Focus on developing a multi-skilled workforce that can adapt to changing business needs. The Future of Jobs report by the World Economic Forum explores how global trends like tech innovation and green transition will transform jobs, skills, and workforce strategies.

Implement a robust learning and development program. Companies that offer comprehensive training programs have 218% higher income per employee than those with no formalized training (according to the Association for Talent Development).

Consider implementing a mentorship program to facilitate knowledge transfer within your organization. This can help preserve institutional knowledge and improve employee retention. A study by Gartner found that retention rates for mentees are 72% higher than for employees who don’t participate in mentoring programs.

Companies with strong employee development programs are better equipped to handle economic uncertainties. These organizations can quickly redeploy talent to address emerging challenges or opportunities.

In Conclusion

Building resilience positions your business for long-term success in the face of economic uncertainties. Financial resilience and operational agility form the foundation of a robust business. A mindset shift throughout the organization cultivates a culture of adaptability and continuous learning, which proves essential during uncertain times.

Hazeltine Executive Search connects top talent with leading organizations across various sectors. Our expertise helps you build a team capable of steering your business through challenging times. We ensure you have the right leaders in place to implement and drive your resilience strategies.

Take action now to strengthen your business’s financial position, operational agility, and workforce capabilities. Your organization can thrive in the face of economic uncertainty with the right strategies and leadership in place. Don’t wait for the next economic downturn to start building resilience.