Chief Financial Officer recruitment has become increasingly complex in today’s dynamic business environment. The role of CFOs has evolved significantly, demanding a unique blend of financial expertise, strategic acumen, and leadership skills.

We understand the critical importance of finding the right CFO to drive organizational success. This blog post explores the key considerations for effective CFO recruitment, helping companies navigate this crucial hiring process.

What Skills Define Modern CFOs?

The role of Chief Financial Officers has transformed significantly in recent years. Today’s CFOs need a diverse skill set that extends beyond traditional financial management. We’ve identified key competencies that define successful modern CFOs.

Financial Expertise Meets Strategic Vision

Modern CFOs must possess deep financial knowledge and apply it strategically. This includes mastery of financial planning, budgeting, and forecasting. However, top CFOs use their financial acumen to drive business strategy and growth.

A CFO recently placed at a mid-sized energy company used financial modeling to identify untapped revenue streams, resulting in a 15% increase in annual profits. This example demonstrates how financial expertise (when applied strategically) can directly impact a company’s bottom line.

Leadership and Communication: The Cornerstones of Success

CFOs can no longer hide behind spreadsheets. Today’s finance leaders must excel in communication and team building. They need to articulate complex financial concepts to non-financial stakeholders, from board members to department heads.

Leadership skills prove equally important. CFOs often oversee large teams and must inspire and motivate their staff. A recent survey by IMA® (Institute of Management Accountants) and Robert Half found that leadership skills are considered critical for success in the CFO role.

Embracing Technology and Data Analytics

In our digital age, technological proficiency is non-negotiable for CFOs. They must feel comfortable with financial software, data analytics tools, and emerging technologies like artificial intelligence and blockchain.

Data analysis expertise provides particular value. CFOs who harness big data to generate actionable insights give their companies a competitive edge. According to a study by Accenture, 81% of CFOs see identifying and targeting areas of new value across the business as one of their main responsibilities.

We’ve observed a growing demand for CFOs with strong tech backgrounds. In fact, 30% of recent CFO placements had previous experience leading digital transformation initiatives.

The modern CFO wears many hats – financial expert, strategic advisor, tech-savvy leader, and effective communicator. Companies that focus on these essential skills during the recruitment process will find CFOs who drive their organizations forward in today’s complex business landscape.

As the role of CFOs continues to evolve, so too does the business landscape they operate in. Let’s explore how these changes impact the responsibilities and expectations placed on modern financial leaders.

How CFOs Reshape Business Strategy

The role of Chief Financial Officers has transformed dramatically in recent years. CFOs now extend beyond traditional financial management to become key strategic partners in driving business growth and innovation.

Strategic Leadership Takes Center Stage

Modern CFOs play a pivotal role in shaping company strategy and driving performance. A survey by McKinsey found that CFOs would prefer to spend less time on traditional finance activities and more on strategic leadership in the coming year.

This shift requires CFOs to develop a comprehensive understanding of all business aspects. They must translate financial data into actionable insights that inform critical business decisions. For instance, a CFO at a renewable energy startup used financial modeling to identify promising expansion markets, resulting in a 30% increase in market share within 18 months.

Risk Management in a Volatile Environment

Risk management has become a central focus for CFOs in today’s unpredictable business landscape. The COVID-19 pandemic underscored the need for robust risk mitigation strategies, with CFOs at the forefront of developing these plans.

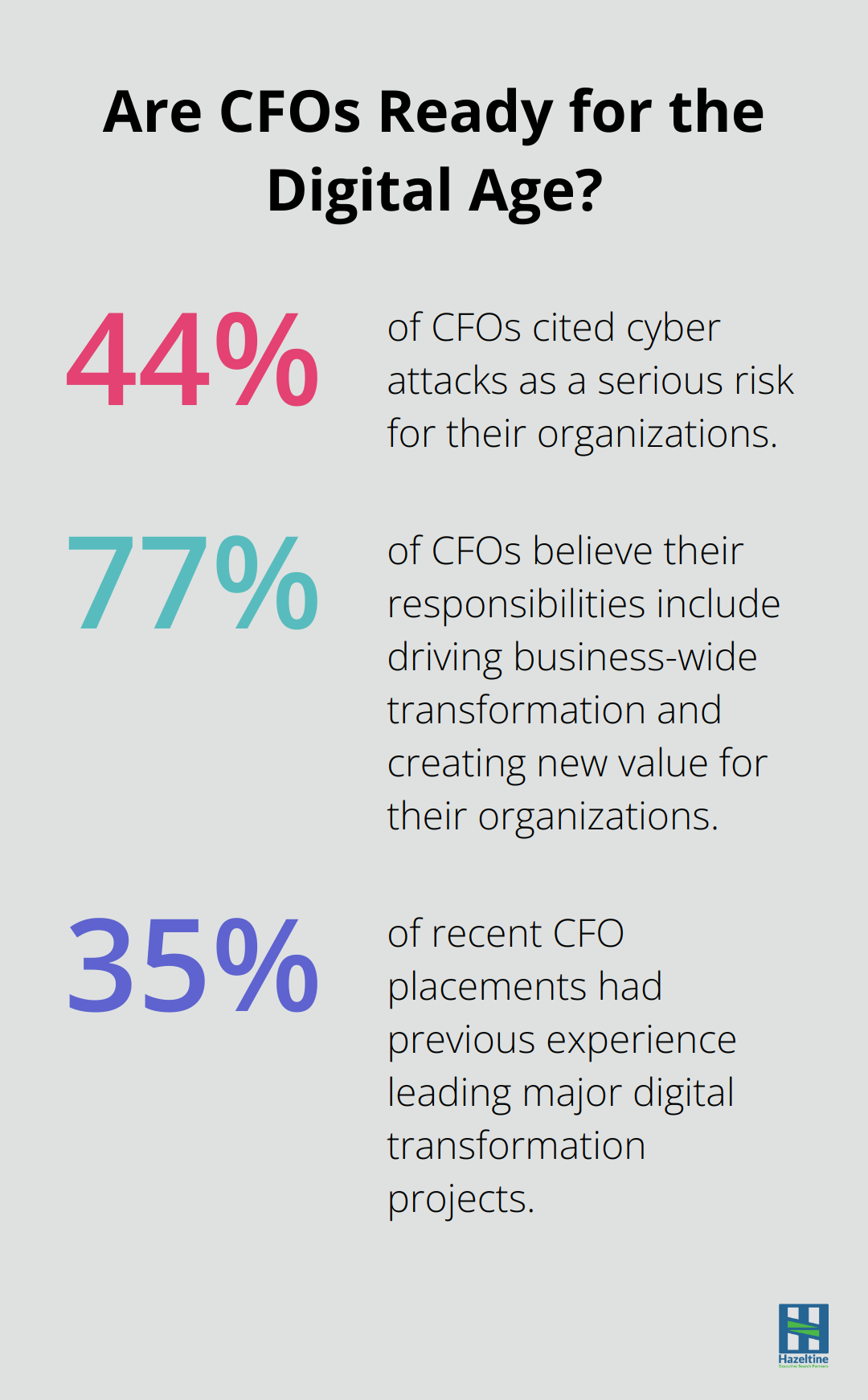

A PwC survey revealed that 44% of CFOs cited cyber attacks as a serious risk for their organizations. This encompasses not only financial risks but also operational, strategic, and cybersecurity threats. CFOs must collaborate closely with other C-suite executives to create comprehensive risk management frameworks that safeguard the company’s assets and reputation.

Catalyzing Innovation and Growth

The most significant evolution in the CFO role involves the increased emphasis on driving business growth and innovation. CFOs must now identify new revenue streams, optimize business models, and lead digital transformation initiatives.

An Accenture study found that 77% of CFOs believe their responsibilities include driving business-wide transformation and creating new value for their organizations. This might involve using data analytics to uncover market opportunities, evaluating potential mergers and acquisitions, or implementing new technologies to enhance operational efficiency.

The demand for CFOs with a track record of driving innovation continues to grow. In fact, 35% of recent CFO placements (across various executive search firms) had previous experience leading major digital transformation projects.

As the CFO role continues to evolve, organizations must adapt their recruitment strategies to identify candidates with the right mix of financial expertise, strategic vision, and leadership skills. The next section will explore best practices for CFO recruitment in this new landscape.

How to Recruit the Ideal CFO

Recruiting the right Chief Financial Officer can significantly impact an organization’s success. We focus on strategies that yield the best results. Here are some key practices we find highly effective.

Craft a Comprehensive Job Description

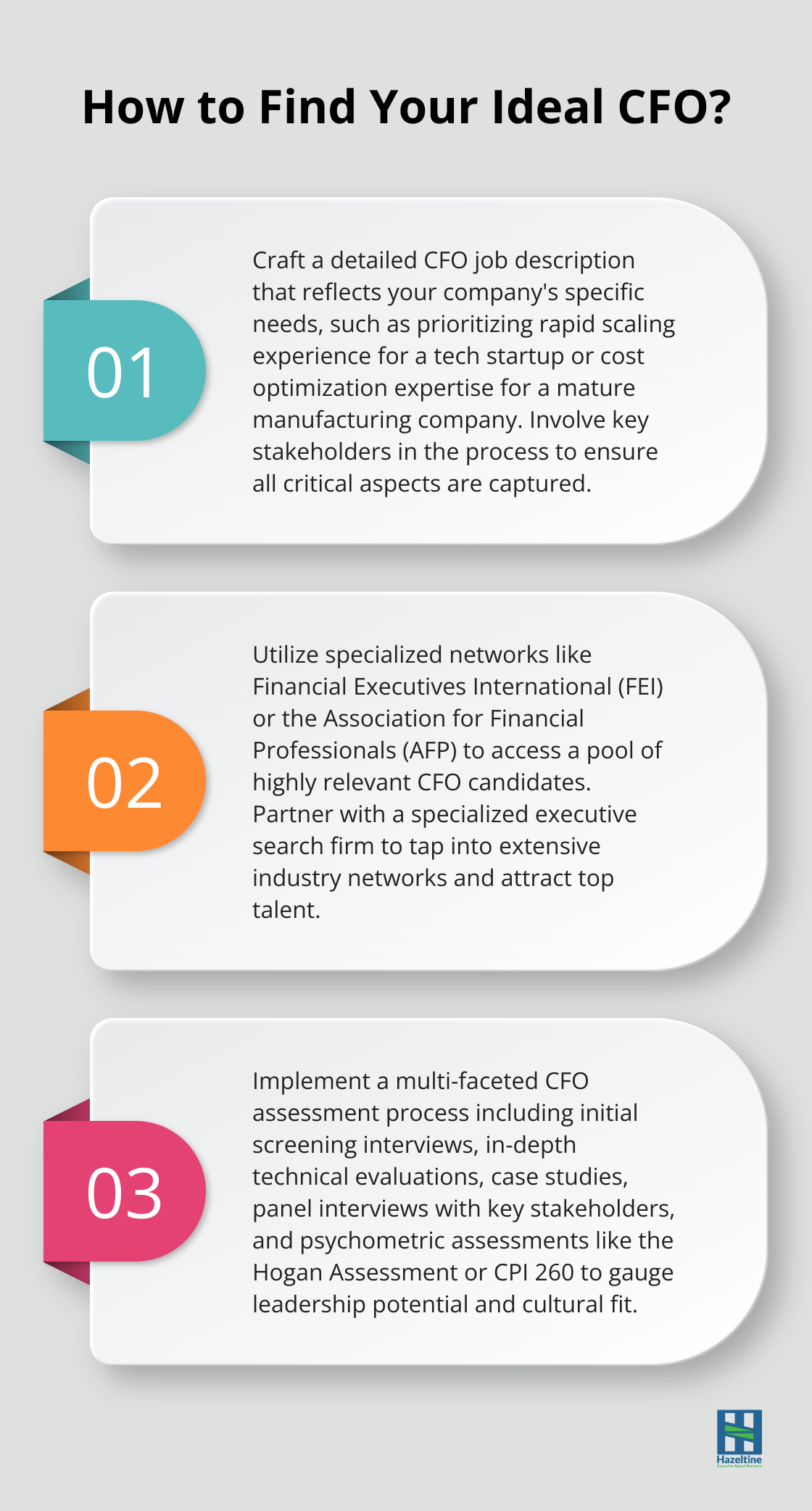

A well-crafted job description forms the foundation of successful CFO recruitment. This document should go beyond listing basic qualifications and responsibilities. It needs to paint a clear picture of the role within the organization’s specific context.

A tech startup might prioritize a CFO with experience in rapid scaling and fundraising, while a mature manufacturing company might seek someone with expertise in cost optimization and supply chain finance. The job description should reflect these nuances.

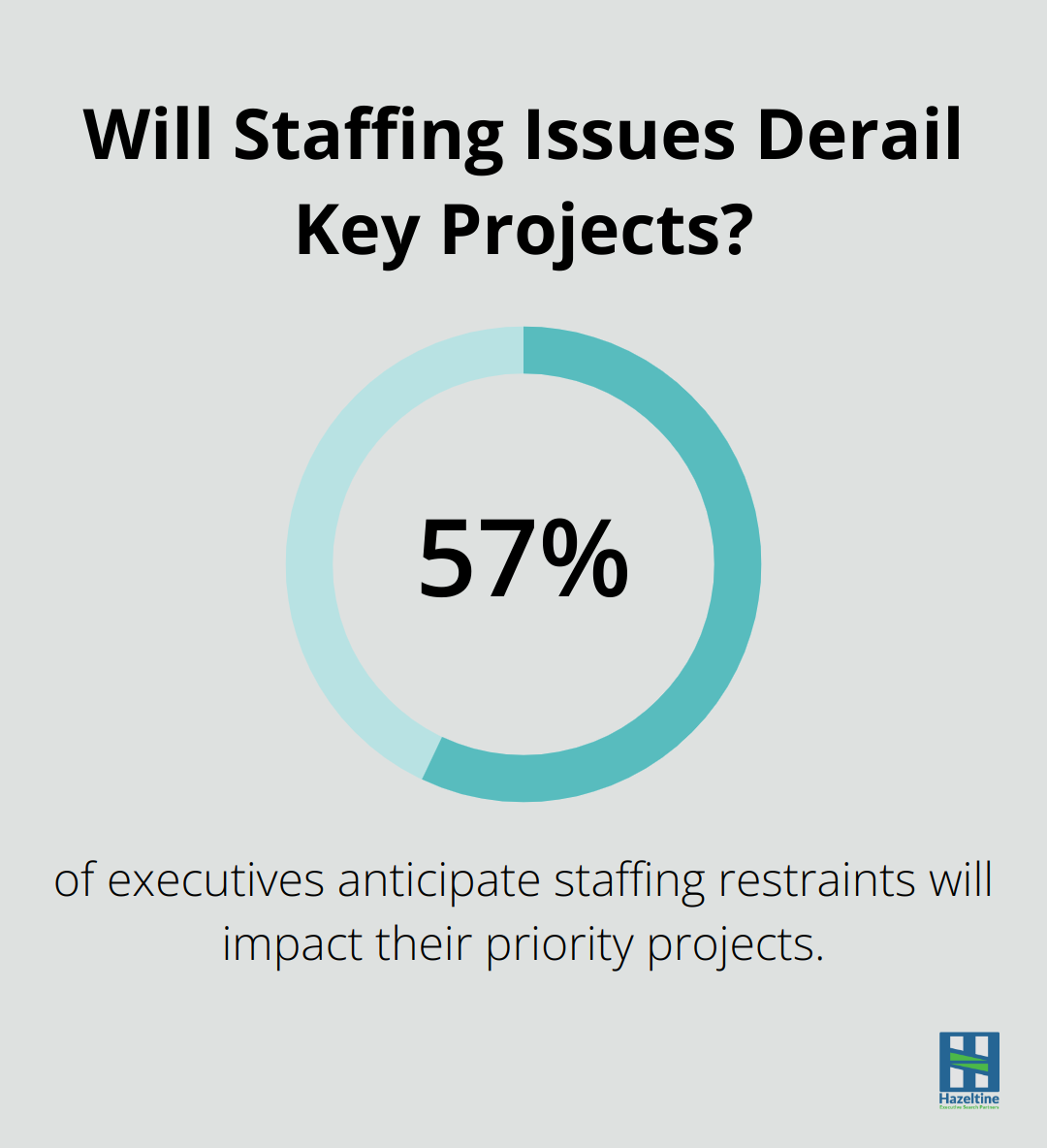

A Robert Half survey reveals that more than half (57%) of executives anticipate staffing restraints will impact their priority projects. To avoid this pitfall, we recommend key stakeholder involvement in the job description creation process. This ensures the capture of all critical aspects of the role and alignment with the company’s strategic goals.

Tap into Specialized Networks

Generic job boards often fall short for executive-level positions. For CFO recruitment, industry-specific networks and partnerships can provide game-changing results. These networks offer access to a pool of candidates with highly relevant experience and skills.

Professional associations like Financial Executives International (FEI) or the Association for Financial Professionals (AFP) can serve as valuable resources. Many of these organizations host events and maintain job boards specifically for senior finance roles.

Additionally, a partnership with a specialized executive search firm (such as Cowen Partners) can significantly enhance the quality of candidates. Extensive networks in various industries allow the identification and attraction of top CFO talent that might not actively seek jobs.

Implement a Rigorous Assessment Process

The interview process for a CFO position should provide comprehensive and multi-faceted evaluation. It extends beyond assessing technical skills; it evaluates leadership potential, cultural fit, and strategic thinking abilities.

We recommend a structured interview process that includes:

- Initial screening interviews to assess basic qualifications and cultural fit

- In-depth technical interviews to evaluate financial expertise

- Case studies or scenario-based assessments to gauge problem-solving skills

- Panel interviews with key stakeholders to assess communication and leadership abilities

Psychometric assessments can provide additional insights into a candidate’s personality traits and working style. Tools like the Hogan Assessment or the CPI 260 offer valuable data to complement interview findings.

Thorough reference checks also play a vital role. Don’t just rely on the references provided by the candidate. Reach out to former colleagues, subordinates, and board members to get a 360-degree view of the candidate’s performance and leadership style.

The CFO recruitment process requires time and effort, but it helps avoid costly hiring mistakes. Clear expectations, specialized networks, and a rigorous assessment process significantly increase the chances of finding the ideal CFO to drive financial strategy and overall business success.

Final Thoughts

Chief Financial Officer recruitment has evolved significantly in today’s dynamic business landscape. The role now demands a unique blend of financial expertise, strategic acumen, and leadership skills. Organizations must prioritize aligning CFO skills with their specific goals and challenges to ensure effective financial strategy and overall business success.

A well-crafted job description tailored to the organization’s unique needs forms the foundation of successful CFO recruitment. Tapping into specialized networks and implementing rigorous assessment processes enhance the likelihood of finding the ideal candidate. Many organizations find value in partnering with specialized executive search firms to streamline the recruitment process and access top-tier talent.

Hazeltine Executive Search offers tailored solutions for Chief Financial Officer recruitment, leveraging deep industry knowledge and innovative processes. We connect leading organizations with exceptional financial leaders (who drive financial excellence and contribute to long-term business success). Our strategic approach acknowledges the evolving nature of the CFO role and focuses on essential skills to meet organizational goals.